Call Me Crazy (Part 2)

Posted by Mark on June 4, 2021 at 17:48 | Last modified: May 17, 2021 16:51Last time, I presented a long call backtesting procedure. Today let’s get into some results.

I used OptionNet Explorer (ONE) to help me with the work. ONE is an excellent piece of software. At some point, I will do a complete review of ONE and compare it with OptionVue.

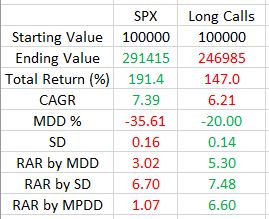

This backtest goes from Jan 3, 2007, through May 13, 2021:

SPX outperformed in terms of total return and compound annualized growth rate (CAGR): annualized return geometric mean.

All of the volatility metrics are in favor of the long call. Maximum drawdown (MDD) is 43% lower for the long call. While it’s bad practice to take a percentage of a percentage (see fourth paragraph here), risk-adjusted return (RAR) by MDD is much better for long call. As MDD is based on one occurrence (2008, in this case), I also calculated RAR by standard deviation to get a broader overview. This still favors the long call albeit only slightly.

Maximum potential DD (MPDD) is how much I can possibly lose were the market to go to zero. For a long call, this is limited as shown in the risk graph here. Until expiration, all I can lose is the amount I paid for the call. With shares, I can lose 100%.

Let’s illustrate with an example. On Jan 3, 2007, SPX traded at 1416.6 and the Dec 2009 1425 call went for $155.20. For the right to buy 100 shares of stock, then, I paid $15,520. The value of 100 shares of stock was $141,660.* Were the stock market to crash and go to zero, I would lose $15,520 owning a long call versus $141,660 owning the shares.

Not a perfect analogy (by any stretch), but a long call is like “paying rent” to participate in stock returns where the most I can lose is the rent itself. If the house is destroyed, then I do not lose the value of the house. If the stock market goes to zero, then I do not lose the total value of the stock. With regard to ultimate risk, such deleveraging may be a game changer. This is why the 60/40 stock-bonds portfolio has long been championed as a diversified portfolio by the financial industry.

I think deleveraging should somehow be factored into RAR because deleveraging lets people sleep well at night (I discussed importance of RAR in the fifth paragraph here). Here, RAR by MPDD is six times better for the long call than underlying stock.

More caveats to be considered next time.

* — SPX cannot be purchased directly. The SPY ETF would suffice, and since its price is 1/10

that of the index, 100 * 10 = 1000 shares could be used as a proxy.